Major retailers are quietly becoming some of the most sophisticated trackers of online shoppers in ways that benefit not just themselves but their ad partners, too. And for consumers who want to cut down on corporate monitoring, hitting “decline cookies” might not make much of a difference.

Retailers have long gathered information on their own customers, like shopping cart contents and spending history. Now, brands like Target, Walmart, Kohl’s, Home Depot, Ulta and Sephora are turning those data troves — many of which got a boost from pandemic-era shopping — into even more valuable tools for precision ad-targeting.

Retailers say these tools allow shoppers a customized experience with brands they trust. But their rise is renewing privacy experts’ concern just as Apple has made it harder for apps to automatically track user data.

“Consumers can opt-out from subscribing to the services or content they like,” said Ido Sivan-Sevilla, an assistant professor in information studies at the University of Maryland. “But once they subscribe, they are becoming ‘part of the game,’ meaning they are creating an identity for themselves with that [data], and consequently, are exposing themselves to tracking.”

Messages on the Target app encouraging users to allow tracking.Target

From third party to first

Changes Apple made last year led some 80% of its users to disable an identifier widely used for ad targeting. The resulting falloff in “third party” data — such as web searches and browsing — created a new opportunity for brands to develop alternatives, which recent surges in e-commerce and loyalty programs have made all the more promising, advertising experts say.

Advertisers “know that we have a large audience, so they’re coming to us more frequently,” said Walmart’s Chief Revenue Officer Seth Dallaire. The number of ad clients Walmart serves rose 121% from the year before, the company announced last month.

For years, online ads have been driven by third-party technology, such as cookies, that follow consumers across the internet, harvesting what data they can about their activity. But with Apple’s privacy changes and Google Chrome looking to phase out trackers by the end of 2024, third-party data is becoming steadily less accessible.

So some retailers are taking the “first party” information they gather directly from their own shoppers, aggregating it in ways that they say remove identifying details, and using it to fuel new initiatives called “retail media networks.” These systems aim to get clients’ ads in front of customers in more sophisticated ways — both in places retailers control, like their own apps and websites, and in others that they don’t, like streaming platforms.

For Home Depot, the drop in available third-party data “is probably one of our primary reasons why we invested in the business” of retail media networks, said Melanie Babcock-Brown, its vice president of integrated media. Ulta Beauty’s Brent Rosso, vice president of the cosmetics seller’s ad business, called retail media networks “the hottest thing in the media world.”

The Home Depot app encourages users to allow tracking. Home Depot

New ways to track and target

Before the rise of retail media networks, retailers regularly sold ad space like sponsored products or banner ads on their own digital properties. But the brands advertising in those spots typically had limited ability to precisely target the people who browsed there.

Now an advertiser can pinpoint consumers more strategically, using audience segments built on actual purchases at specific retailers, not just the movements of casual online window-shoppers, said Ben Sylvan, general manager for retail data partnerships at The Trade Desk, the ad-tech company behind Walmart’s media network. (The Trade Desk also advertises on Peacock, which is owned by NBCUniversal, the parent company of NBC News.)

This shift helps explain, for example, why someone who opens Target’s mobile app to shop for table lamps or tomato sauce might be hit with a pop-up asking permission to be tracked across Target and other apps and websites.

In a statement, Target said in part that its branded message is “consistent with other retailers” in explaining how opting into tracking “will result in personalized advertisements and an even more customized shopping experience.”

Apple’s tracking transparency guidelines require apps to request permission to track users across external apps and websites, among other obligations. Google requires Android and Play developers to tell users what type of data is collected and how it is used as well as the app’s privacy policy.

Typically, retail customers’ data is shared only anonymously with advertisers, so that private information like names remains protected, said Elizabeth Marsten, group director of strategic marketing services with the e-commerce marketing firm Tinuiti.

But many retail media networks combine first-party data with existing third-party information, such as demographic data, to build more detailed profiles on consumers.

As some online privacy researchers see it, the methods may be changing, but the outcome is similar. “It’s ridiculous to think that without cookies that anything will change” in how companies target ads, said Sivan-Sevilla, with the University of Maryland, adding that there’s little consumers can do in the meantime to wrest back more control. “It’s a structural and incentives-based problem.”

Consumers can limit tracking by checking out as a guest on a shopping site, for example, or using a privacy plug-in on certain browsers, Sivan-Sevilla said. But companies can still use less efficient tracking technologies like fingerprinting, which creates an identifier by gathering detailed information on a user’s software and device settings through their browser. A retailer may also be able to track shoppers who opted out of tracking but opted in through another brand or company that partners with the retailer.

“There is no user autonomy in how we’re tracked because of how the system is structured,” he said.

Advertisers argue that consumers knowingly trade some details about their activities for a more personalized ad experience. And the shift toward first-party data means customers can increasingly strike that bargain directly with a brand they already like and trust.

“Customers have raised their hand and said, ‘Yes, capture that information. Know me the way that you know me, so you can market to me better,’” said Ulta’s Rosso. “And because of that information, we’re able to target media and marketing in a much better way than historically we have been able to do.”

More and better data

Recent shifts in consumer behavior have also aided retailers’ ad targeting efforts.

E-commerce surged to roughly $960 billion, or about 14% of total retail sales, by the end of 2021, according to the U.S. Census. That surge delivered reams of first-party data at volumes and with a level of detail many retailers had never seen before, according to industry experts.

And with inflation still squeezing wallets, shoppers have been rushing to join loyalty programs like Target Circle and Walmart Rewards to get discounts or cash back — expanding the influx of first-party data available to power retail media networks.

A full 80% of U.S. shoppers are members of at least one loyalty program, according to a July report from LendingTree. In return for rewards, members are increasingly asked to agree to share data, which could include average basket size, shopping trip frequency and purchase history, for use by advertisers beyond the brand operating the program itself. Loyalty program data is among the most valuable information retailers collect on customers, according to Andrew Lipsman, principal analyst with eMarketer’s Insider Intelligence.

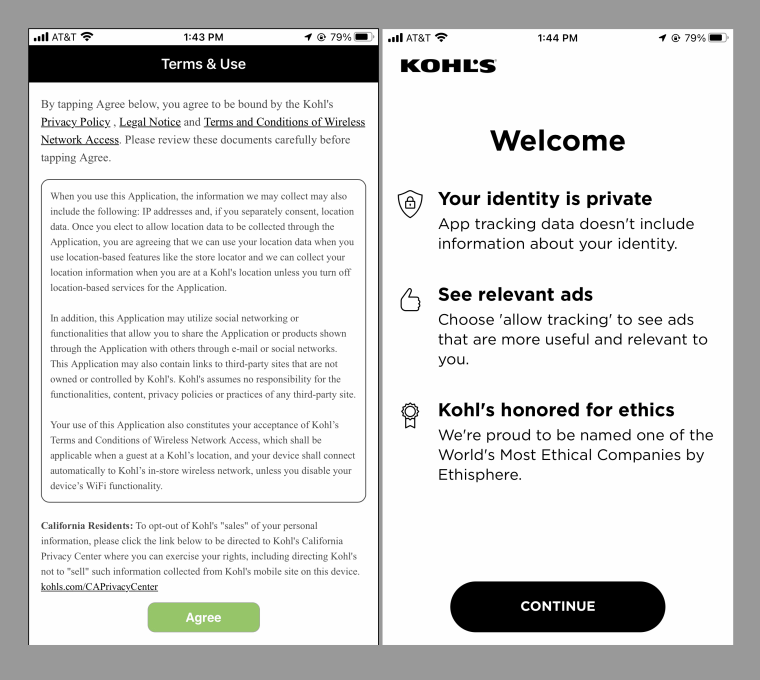

The terms of use in the Kohl’s app describing how a user’s information will be collected, left, and an option to “allow tracking.”Kohl’s

The terms of use in the Kohl’s app describing how a user’s information will be collected, left, and an option to “allow tracking.”Kohl’s

About 95% of all Ulta transactions are tied to its loyalty program, which now includes about 38 million shoppers, Rosso said. Target and DSW, which both operate their own media networks, have said they have 100 million Circle members and 30 million VIP members, respectively. Macy’s, which also runs an ad network, said last month it has about 30 million active rewards members.

After a sharp downturn early in the pandemic, total U.S. ad spending is expected to hit around $346 billion this year, up 13% from last year, according to eMarketer. About $40 billion will be spent this year across retail media networks alone, the analytics firm projects.

Advertising generally makes up a small share of retailers’ overall business, and those that are building media networks typically don’t release details of their programs’ financial performance. But the nascent platforms, which retailers frequently tout to investors as promising new revenue streams, are growing fast.

In February, Walmart reported earning $2.1 billion in ad revenue worldwide in 2021, though still a fraction of the $35 billion in total revenue it booked that year. Target earned $724 million in “other revenue,” a category that includes advertising and third-party sales, out of $51.2 billion in the six months ending in July, according to its most recent earnings report. And Amazon reported in February that its advertising business — which now trails only Google and Facebook for market share in digital ads — brought in about $31 billion in revenue, out of $469 billion in overall net sales revenue last year.

Where the law comes in

In the meantime, brands’ handling of first-party data is facing mounting scrutiny. A bipartisan data privacy bill that passed out of the House Committee on Energy and Commerce in July would limit the collection of personal information, allow consumers to access their data and hold companies accountable for discriminatory algorithms. Several large data brokers have increased their lobbying spending to fight the bill, according to disclosures reported by Politico, saying it would hamper criminal investigations and squeeze the advertising business.

At the same time, lawmakers in California have started widespread enforcement of its 2018 privacy law. Attorney General Rob Bonta said in August that the “kid gloves are coming off” in announcing a $1.2 million settlement with Sephora over allegations that it sold customers’ data without telling them. The LVMH-owned beauty retailer was accused of allowing third parties to create profiles about consumers, including their computer models, their locations and the brands of products in their shopping carts.

Sephora didn’t admit liability under the terms of the settlement, and the company said it has always complied with the California law. It notes that shoppers have a number of tools, including on its own site, to opt out of “this personalized shopping experience.”

It isn’t clear whether retail media networks violate California’s privacy laws or would come under enforcement if the federal privacy bill is enacted, said John Davisson, senior counsel with the Electronic Privacy Information Center, which backs tighter controls around consumer data.

“A lot turns on what is made clear to the consumer at the time they’re enrolling in a loyalty program,” he said, including “whether they believe they are just signing up for it to market products to them or whether they are opting into something bigger.”